Monmouthshire County Council is undertaking a consultation exercise about charging a council tax premium on long-term empty properties and second homes in the county.

Long-term Empty properties

A long-term empty property is defined as a property which is both unoccupied and substantially unfurnished for a continuous period of at least one year. There are currently about 400 long-term empty properties in the County. At the moment these properties are subject to a full council tax charge (100%).

The Council is seeking views about whether a council tax premium should be introduced on long-term empty properties.

The Council has the discretion to charge a premium of up to 100% (300% from 1st April 2023) of the standard rate of council tax on long-term empty properties. A premium would mean that an extra amount of council tax would be added to the annual amount due for a property. This extra amount is the ‘premium’ and it could be up to 300% of the standard annual charge. The objective of an empty homes premium would be to provide an incentive for encouraging occupation.

Under the legislation, Monmouthshire County Council has to decide whether to introduce a council tax premium on long-term empty properties before the 31st March 2023 in order to introduce the new charges from 1st April 2024.

The council want to hear your views about whether a council tax premium on long term empty properties should be introduced and if introduced what level of premium to apply (e.g. 50%, 100%, 200% etc)

Second Homes

A second home is defined as a dwelling which is not a persons sole or main home and is substantially furnished. These might include dwellings that are used as a holiday home or be an inherited property which isn’t the owners main residence.

Currently there are approximately 190 second homes in the county. These properties are subject to a full council tax charge (100%).

The Council has the discretion to charge a premium of up to 100% (300% from 1st April 2023) of the standard rate of council tax on second homes. A premium would mean that an extra amount of council tax would be added to the annual amount due for a property. This extra amount added is the ‘premium’ and it could be up to 300% of the standard annual charge.

Under the legislation, Monmouthshire County Council has to decide whether to introduce a council tax premium on second homes before the 31st March 2023 in order to introduce the new charges from 1st April 2024.

The council want to hear your views about whether a council tax premium on second homes should be introduced and if introduced what level of premium to apply (e.g. 50%, 100%, 200% etc).

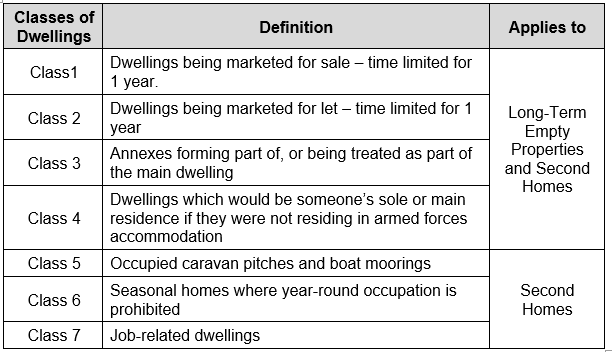

Properties that would be exempt from any council tax premium

There are a number of exemption classes which specifically apply to long-term empty properties and/or second homes. Where a property falls into one of these classes the council is not be able to charge a council tax premium.

The council tax system already provides a number of specific exemptions from council tax. There are a number of exemptions in place for unoccupied dwellings, such as, for example:

· where the resident is in long-term residential care or hospital,

· where a dwelling is being structurally repaired (for up to one year),

· where the resident has died (for up to six months after grant of probate or letters of administration).

A dwelling that is exempt from council tax is not liable for a premium

The County currently has extremely high levels of homelessness. A large amount of the Council’s finances are dedicated to providing short term emergency accommodation. In line with Welsh Government guidance the council is able to retain any additional revenue generated from these premiums to help bring long term empty properties back into use to provide safe, secure and affordable homes and to help to increase the supply of affordable housing and enhance the sustainability of local communities.

You can contribute to this consultation by completing our online form – Consultation – Council Tax Premiums for the long term empty properties and second homes

If you require the form in another language or format or require assistance in completing the form please telephone 01633 644644 or email contact@monmouthshire.gov.uk and we will be happy to help.

The deadline for responses is noon on Thursday 16th February 2023.